In the ever-fluctuating world of investing, building a portfolio that stands the test of time requires more than just picking winners. UK-based investment giant Hargreaves Lansdown is leading the charge with its latest recommendations on fund pairings designed to create balanced, resilient strategies. Drawing from expert insights shared via Trustnet, the platform highlights how combining complementary funds can smooth out market volatility, enhance diversification, and support long-term growth. As economic uncertainties linger post-Brexit and amid global shifts, these pairings offer practical guidance for everyday investors using ISAs, SIPPs, or general savings accounts.

Why Fund Pairings Matter for Modern Investors

Markets are notoriously unpredictable—think rapid tech booms followed by inflation-driven dips. No single investment style thrives in every condition, as noted by Kate Marshall, lead investment analyst at Hargreaves Lansdown. "Bringing together contrasting approaches can help create a more balanced and resilient portfolio," she explains. By pairing funds with differing styles, regions, and risk levels, investors gain reassurance during downturns and momentum in upswings.

This approach aligns with core principles of diversification, reducing correlation between holdings so that when one falters, another may hold steady or rise. For UK investors, where platforms like Hargreaves Lansdown dominate with over £120 billion in assets under administration, such strategies are accessible via user-friendly apps and tools. The four pairings outlined below showcase real-world examples, backed by performance data from FE Analytics, emphasizing low correlations (under 0.5 in most cases) for true complementarity.

Growth and Value: Balancing Innovation with Stability

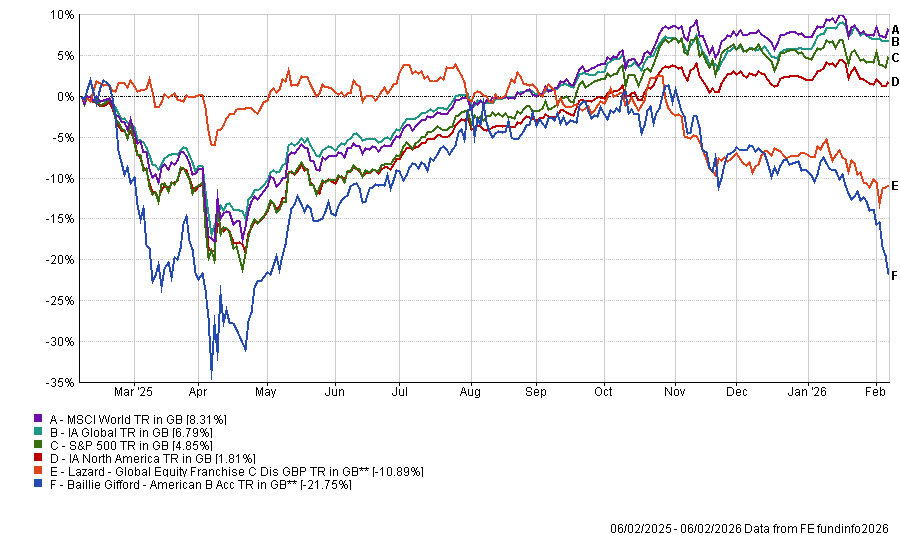

The first duo contrasts high-octane growth with steady value plays: Baillie Gifford American and Lazard Global Equity Franchise. Baillie Gifford American, co-managed by industry heavyweights like Tom Slater, targets innovative disruptors in the US—think tech giants and emerging leaders poised for explosive earnings. It's delivered second-quartile returns against the IA North America sector over the past year, but its volatility shines through in longer periods: fourth quartile over one and five years, third over three.

Enter Lazard Global Equity Franchise, which hunts undervalued quality companies globally, with a lighter US tilt than peers. This value focus buys when prices are low, emphasizing predictable earnings over hype. Marshall highlights how this pairing counters growth's swings; their three-year correlation is a mere 0.43%, meaning they've rarely moved in lockstep. In a year of tech sell-offs, Lazard could stabilize while Baillie Gifford rebounds on innovation waves. For UK portfolios, this mix diversifies beyond domestic biases, ideal for those eyeing global exposure through a Hargreaves Lansdown ISA.

Equity and Bond: Navigating Risk Across Asset Classes

Next, Hargreaves Lansdown pairs equities with fixed income for broader protection: Rathbone Global Opportunities and Invesco Tactical Bond. Managed by Alpha Manager James Thomson, Rathbone seeks worldwide growth stocks, but it's prone to sentiment-driven dips—down 5.3% in the year to January 2022 amid global sell-offs and 3.2% to January 2026. Its FE risk score of 104 underscores this higher volatility.

Balancing it is Invesco Tactical Bond, helmed by Stuart Edwards and Julien Eberhardt, with a conservative risk score of 40. This fund tactically navigates bonds for income and capital preservation, often zigging when equities zag. Their correlation sits at 0.40, low enough to buffer stress periods like rising interest rates or recessions. Marshall notes that while not perfectly uncorrelated, this equity-bond blend behaves differently in crises, providing a safety net. UK investors, facing potential rate hikes from the Bank of England, could use this in a SIPP for retirement resilience, blending growth potential with downside protection.

Core and Satellite: Passive Efficiency Meets Active Edge

A classic strategy gets a Hargreaves Lansdown twist in the core-satellite pairing of Fidelity Index World and Jupiter India. Fidelity Index World serves as the low-cost core, tracking developed markets with broad exposure. It's outperformed the IA Global sector by delivering 7.6% returns over the past year versus 5.9%, thanks to efficient indexing that captures global blue-chips without active fees eating into gains.

The satellite, Jupiter India, adds active spice with a concentrated bet on India's booming economy—high-risk, high-reward. It soared 35% in 2021 on emerging market tailwinds but can falter in global risk-off modes. This setup leverages passive stability for the bulk of the portfolio while using active India picks for outperformance potential. Correlation data isn't specified here, but the regional and style divergence implies diversification benefits. For British savers diversifying beyond Europe, this pairing via Hargreaves Lansdown's platform taps into Asia's growth story without overcomplicating core holdings.

The Fourth Pairing: Emerging Markets and Defensive Plays

While the source cuts short on the final duo, Hargreaves Lansdown's philosophy extends to pairings like emerging markets funds with defensive sectors, such as consumer staples or utilities. Imagine combining a volatile emerging markets ETF with a low-volatility global equity fund. This would further emphasize resilience, targeting correlations below 0.5 to weather geopolitical tensions or commodity swings affecting the UK economy.

Overall, these recommendations underscore Hargreaves Lansdown's commitment to evidence-based investing. Platforms like theirs make implementation seamless, with tools for monitoring correlations and rebalancing. However, Marshall cautions wise selection: assess your risk tolerance, time horizon, and fees before diving in.

Implementing These Pairings: Tips for UK Investors

To apply this at Hargreaves Lansdown, start with their Funds Centre or ETF Quicklist for research. Use the SIPP Builder for retirement-focused tweaks or ISAs for tax efficiency. Diversification isn't foolproof—past performance (sourced from FE Analytics) doesn't guarantee future results—but low-correlation pairs historically mitigate losses.

In today's landscape, with inflation at 2-3% and stock markets rebounding, these strategies empower investors. Whether you're a novice saver or seasoned trader, Hargreaves Lansdown's insights remind us: investing is a marathon, and the right companions make all the difference.

As of February 2026, these pairings reflect current market dynamics, but always consult a financial advisor. For more, explore Hargreaves Lansdown's market news and investment ideas sections.